Tax Planning

As we progress in life, we make investments and derive income from multiple sources – wages, interest, rent, capital gains and so forth. And we are liable to pay tax on all such incomes, albeit at different rates. While all these incomes are “money”, the tax law distinguishes them into 2 categories – Cash Assets & Capital Assets.

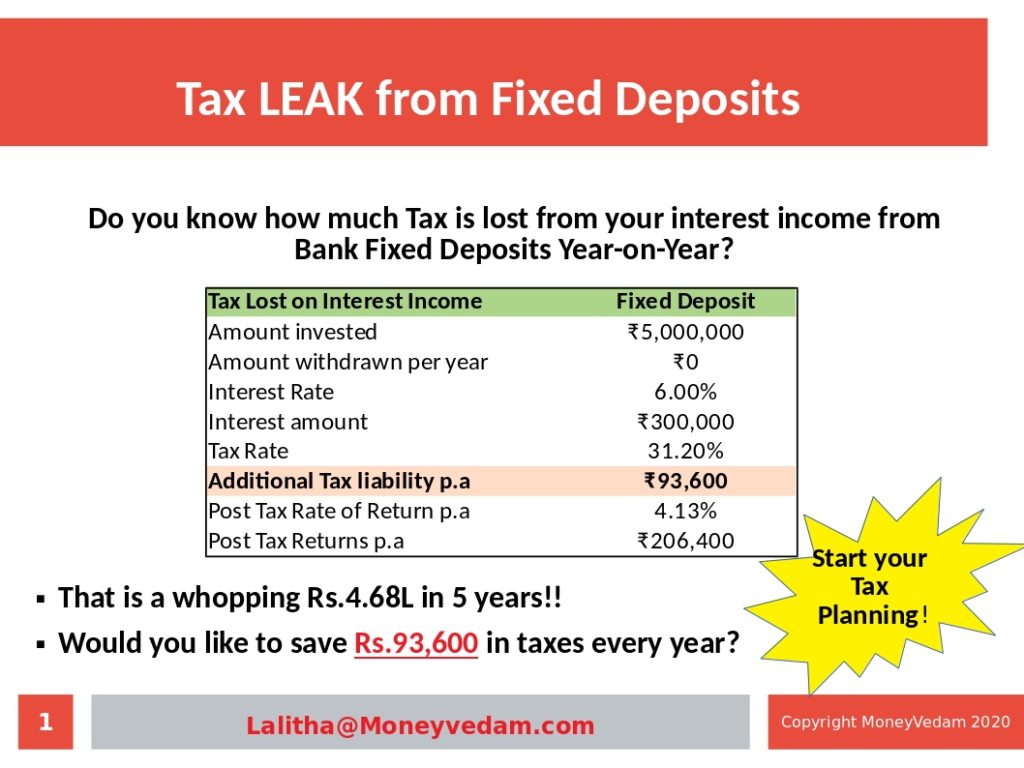

Certain assets such as fixed deposits and recurring deposits form cash assets. These assets are generally regarded as safe, offer moderate returns and are taxed based on your income slab. On an average, about 60-70% of one’s financial assets is held in fixed deposits, which are highly taxed (30%).

Physical assets such as property, land, gold and capital market instruments such as stocks, bonds & mutual funds form capital assets. From a tax perspective, capital assets are more tax friendly than cash assets.

First, we understand the tax liabilities arising from various sources of your current year’s income and recommend investing in suitable tax saving instruments in a structured manner. This enables you to obtain the dual benefit of saving tax as well as gaining better ROI from these investments.

Next, we delve into your existing asset structure and identify areas of major tax leaks. Our tax planning could show how a simple re-structuring of your assets could help you not only save tax, but also double / treble your returns!!

The focus here is to save tax outgo from your hard earned income accumulated over several years of your career and make your money work smarter for you. This is where we could add significant value to you in saving excess taxes year-over-year for many years to come.

While resident taxation is sufficiently complex, needless to describe the state of NRIs as they are far more stretched on time to attend to tax matters in more than one country. This is an area we could be of assistance to NRIs – from determining if they are liable to file their tax returns in India to covering tax aspects of investments, capital gains and repatriation (with DTAA as applicable). Planner’s value-add comes in specifically to returning NRIs who needs advice on tax implications of their overseas income/assets in India and in preserving their dollar-investments against rupee depreciation.

Sathish Kumar

Hi ,

I want to reduce my annual tax in a efficient way.Please reach out to me for further discussions. Mobile Number:7358442512