How to time the entry/exit of investments?

Even the most successful investors are a little lost when it comes to timing the entry/exit of any asset – be it real estate, gold, mutual funds or stocks. Let us take the case of Ajay, who invests in stocks with an aim of making a quick profit of 10-12% in the short term by timing his entry and exit based on news & stock movements.

Ajay had invested Rs.5Lacs in the stock market in Oct’16 in a few counters. By Sep’17, his stock portfolio jumped 40%, so he sold his stocks & cashed in gains of Rs.2Lac. He re-entered the market in Mar’18, but due to the recent correction, his stock portfolio is down 10%. So, his portfolio went up from Rs.5L to Rs.7L and is now down to Rs.6.3L over a 2 year period – this translates to 12.25% in annualized returns, matching nifty returns of 12% in the same period.

Note that although Ajay cashed in 40% gains, he was not invested in the market at all times. He was entering and exiting the market at different times. So, his money was idling some times & hence his annualized returns is 12.25%.

This is an episode of a very successful investor as the rally from Jan’17 helped boost his returns. However, it is not possible to replicate this kind of success at all times because it requires the investor to monitor the stock market on a daily basis and take action. Also, the stock market does not rally all the times, it falls or stagnates at other times. Many investors who got into the market in 2010 in certain sectors such as infrastructure & realty lost up to 60-80% of their invested amount. But that does not mean one cannot take advantage of the equity markets.

How to handle the timing risk?

You could turn the timing challenge to your advantage by building a portfolio of equity funds using SIPs (Systematic Investment Plan), based on your risk taking capacity. The secret here is to understand that there is an “appreciation time line” associated with every asset class. And the appreciation time line for equity mutual funds is 5-7 years.

If you expect reasonable double digit returns (12-15% p.a) from equity mutual funds, you need to stay invested for 5-7 years to allow it to multiply. If your personal financial goal of say funding your son’s education, is only 2-3 years away, then equity funds may not provide you with the kind of returns you expect, because equity returns are volatile in the short term.

Do SIPs really work?

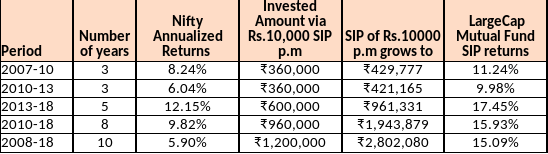

To answer this question, let us analyze Ajay’s SIPs. Ajay also invests Rs.10,000/- per month via SIPs in a mix of 3 large cap funds since 2007. If you look at the 3 year periods 2007-10 & 2010-13 in the below table, his returns from SIPs in largecap mutual funds is 10-11% p.a, compared to 6-8% Nifty annualized returns. Similarly, for a tenure of 5 or more years, his returns are 15-17% p.a, compared to 6-10% nifty annualized returns.

Between 2008-2018, the markets peaked 4 times and fell 6 times. It also had a long stagnation period from 2010 to 2013, when nifty returned 6% (vs) 10% from fixed deposits. Despite all this, his steady monthly SIP of Rs.10,000, totaling Rs.12Lacs over 10 years, had grown to Rs.28 Lacs in his portfolio today.

If Ajay had invested the same Rs.10,000 in a 10 year recurring deposit, his maturity amount would be Rs.18Lacs (vs) Rs.28Lacs from his largecap mutual funds portfolio. SIPs have generated the additional Rs.10L return for him. Again, not all 100% of your money should be put into equity funds, it is important to allocate a portion of your total investments in equity funds to reap higher market returns.

Still puzzled?

As each investor is unique, the risk and return preferences of each investor too varies significantly. Spend quality time to understand the financial products or consult experts / advisors to determine the suitability of various financial products based on your risk taking ability. You could then align your investments with each of your expenditures in future so as to meet all your financial needs comfortably. A simple portfolio with 4-6 funds & a disciplined approach to investing is all that is required to beat the timing risk.

Leave a Reply