Mutual Funds for Financial Planning?

Although mutual funds carry risks, time & again, it has proven to be one of the best tools to create wealth over long term by carefully choosing funds and aligning them with one’s investment portfolio. In this article, let us understand how mutual funds help in accumulation of wealth.

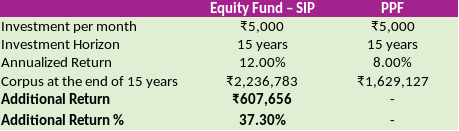

Wealth Creation using SIPs

Goal based investing

As evident from the above table, it is simple to create wealth using SIPs (Systematic Investment Plans). But tying these investments with your financial goals is important from two aspects – first it helps you to realize that a key milestone such as your children’s education could be built with small regular contributions over a fixed tenure (15 years) instead of having to save several lakhs of rupees in the last 2 years leading to their college admission.

Next it helps you to stick to your investments regardless of market conditions because every investment has a rational financial goal behind it (similar to your term insurance plan). People who do not have a goal behind an investment find it very hard to stick to the plan due to fear of loss and lack of focus.

The goals could be strategic such as child education, wedding expense or building a retirement nest or they could be near term such as buying a house or car. Most investors think that investing is applicable only during the income earning phase of one’s life. However investing is equally important in one’s retirement phase too. Most urbanites live for an average 20 years after retirement and depending on fixed deposits alone would not help them meet their retirement income needs. Whatever be your goal, your financial planner could structure a portfolio that offers you returns that are commensurate with your needs and risk propensity.

Leave a Reply