In Part-I, we explored 4 major leakages, which if prevented, could go a long way in saving your hard earned money. In this article, we are going to see 4 smaller but recurring leakages, which if left unnoticed, could deprive you of a significant contribution to your long term wealth.

Leak 5 – Tax outgo

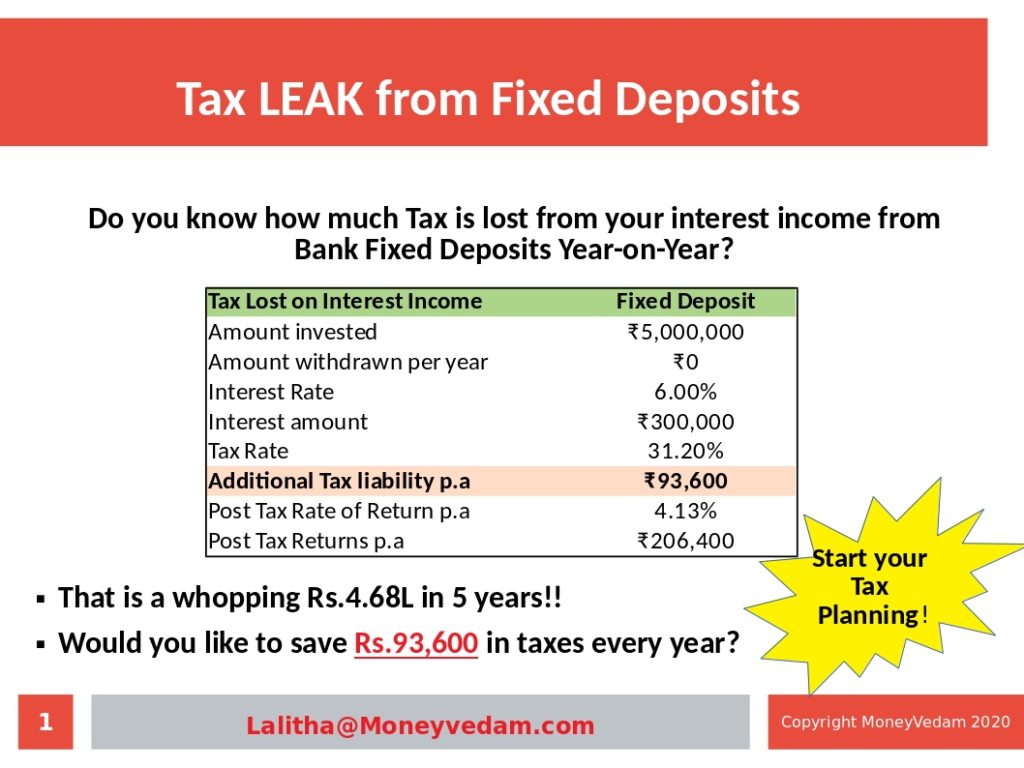

EPF/PPF, children’s education fees & any home loan principal you pay takes care of your income tax rebate in section 80c. However, for those in the middle years of their career, who have completed their EMI liabilities, you may wonder if there are avenues beyond section 80c to save tax. This requires a fundamental shift in viewing assets as cash (or) capital assets. Cash assets such as bank FDs are draining on tax, so you may consider switching a part of them to tax efficient capital assets such as debt funds to plug the tax leakage.

Lets say Guru has Rs.25Lacs in bank Fds and he falls in the 30% income tax bracket. At 7% interest, he earns Rs.1.75Lacs on which he needs to pay Rs.54000 as tax – so his post tax returns is only 4.82%. Instead if he moves his Rs.25Lacs to a good quality debt fund, which offers a 7-7.5% return, he does not incur any tax outgo until he redeems his units.

By moving to good quality debt funds, over a 3 year period, Guru could have saved Rs.1.63 Lacs in taxes. And his Rs.25Lacs portfolio could have grown to Rs.31Lacs, in comparison to his FD plus re-invested interest at Rs.28.6Lacs. And imagine his tax savings over a 10 year period could add up to Rs.5.4Lacs (Rs.54k * 10)!

Leak 6 – Regular Plans of Mutual Funds

When you are a new investor in capital market instruments, there are many procedures such as KYC, extended-KYC & FATCA to be completed, may be more. So, it makes sense to start investing with your bank or broker, who could help complete these paper work for you. Such funds when bought through your bank or other distributors form “Regular Plans”. The expense ratio on these plans are higher than their “Direct Plan” twin.

Over time, with continued investing, your portfolio grows to a decent size say Rs.30Lacs – by then you may have gained knowledge of mutual funds & it would be a better idea to start switching to direct plans. The difference in expense ratio between regular plans & direct plans could be 1-1.25% on equity funds, which could trickle up to few lakhs over a 10 year period. However, it might help to review your portfolio with experts on an annual basis to ensure your portfolio has good mix of funds. Direct plans help you save the leak from the higher expense ratio of regular plans.

Leak 7 – Credit Card & Bank Accounts

Pay your credit card bills on time, always in full, unless it is a 0% interest purchase. Otherwise you will end up paying more interest like in the home loan case. Most people may also have 5 bank accounts in different cities, although they may use only 1 or 2 frequently. And in case you leave Rs.20000 as minimum balance in each account, your combined minimum savings account balance itself would be Rs.1Lac, earning a low 3.5%.

For each account, you may also have debit/credit cards, demat accounts or mutual fund folios. If left unnoticed, banks would be charging you up to a total of Rs.2000 per year per account. So, plug such smaller leaks too and use the saved Rs.5-6k to donate or even spend it on yourself. Even if this is too small a savings for you to ignore, do not neglect the fact that least used or unused accounts become victims of bank account frauds.

Leak 8 – Jewels

This is the only product in the country where someone daringly puts up a front page full size ad saying “only 10% wastage” and we still go for the purchase without one question. Alright, you paid for a 10% wastage, now are you being handed over the wastage gold as scrap? NO. Imagine a fund house or mobile company puts up a similar ad saying “only 10% wastage” – would any of us buy such a mutual fund or mobile? So, while we buy gold jewels for the love of gold and the pride of wearing it, be a little mindful before investing a good part of your hard earned money in gold jewels and save the leakage, especially in old gold exchanges.

Is that all?

Not really, in every transaction that you come across in life, price could be inflated due to many factors – brand (white goods), season (air-ticket, hotels), premium for reputed schools (admission / non-tuition fees) etc. It would help if we remember the tag-line “buyer beware” whenever we make a purchase. It might not be possible for us to fix all leaks, but the secret is to fix the big & recurring leaks. Remember there is no right or wrong choice here, it is all about making an informed choice – after all it is your earnings and so the choice is yours to make!