The Great Gold Rush 2020

Gold has been galloping and has returned 54% in INR absolute returns since jan/2019 and 38% since jan/2020. In fact it seems to be in a race with the stock market and has got a wide spectrum of investors puzzled and interested at the same time.

Gold comes with a long investing history and is often seen as a safe asset class in times of crisis. While trade war in 2019 created some to shift their investing to gold, the stock market plunge due to covid-19 caused gold price to spiral up 48% from $1281 (01/2019) to $1894 (01/2021).

Why the great rush?

Traditionally gold has an inverse correlation with the stock markets. When stocks are down, gold rises and vice versa. Gold is also known to have an inverse relationship with the USD. As gold itself is denominated and traded in USD, when USD strengthens, gold falls and vice versa.

However, since the GFC (Great Financial Crisis 2009) and the invention of money printing, the correlation between stocks and gold stands broken. This is due to cheap liquidity made available in plenty by the Fed ($7.24Tn) and other developed market central banks over the last decade (2010-2020).

Basic economics tells us that when demand rises without rise in supply, it results in a price rise. As more and more cheap cash chases fewer stocks in emerging market equities, it pushes up their prices and makes their valuations extremely high (Nifty P/E 38).

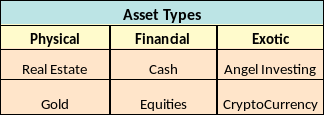

Domestically, whenever real interest rates turn negative, savers are disincentivized to save in cash assets such as fixed deposits and move to capital assets like stocks, or physical assets like gold and property. HNIs on the other hand move to exotic assets such as angel investing and cryptocurrencies, which explains the bubble in startups and bitcoins.

Did you miss out?

From a personal finance perspective, gold is just one among many types of assets held in an individual’s portfolio. It is quite similar to a plot of land in that it does not generate any passive income and may take long tenure to appreciate in value. Its price may rise/fall in the interim years depending on various factors such as real returns from other asset classes, political instability, social unrest, trade/currency/civil war and more importantly policies of central bankers.

Prior to 2013, long term return from gold over 20 years in rupee terms was 6% barely meeting inflation. Only post QE, return from gold is in the range of 10-12% p.a, very similar to returns from equity markets. And its outlook for 2021 is at $1900-$2300/oz. As long as you have a well diversified portfolio in different asset types, it would help you ride the upside and tide the downside – so that you could grow your portfolio and fulfill your personal financial goals.

Also read: Sovereign Gold Bonds