How to Tide over Covid?

Most of us are experiencing a pay cut or job loss or secondary income loss of some sort. There is absolutely no one that is not affected by covid economically and financially. Given the forewarning from medical experts that this virus is going to stay in the system for the next 2-3 years, how do we tide over the financial impact caused by this virus?

- Emergency fund

The 3 month or 6 month emergency funds we held would now dry up fast, given the timing of this virus – yes, beginning of an academic year. Annual or term/semester fees of schools & colleges become due from May and hence they deplete any emergency reserves we hold. - Interest from Bank FD

In case you have been saving diligently over your working years and say have Rs.50 Lacs in bank FDs, you might take refuge about the sizeable corpus. However, with sub-6% interest rates today, you might only receive close to Rs.3L interest p.a, which is not sufficient to meet your liabilities. - Apportion money for expenses

Another strategy most people would consider to diffuse the situation is to set aside the entire expenses for next 3-4 years. But by doing so, at least half of the Rs.50L savings gets depleted. - Rework the Math

If you desire to receive Rs.6L income p.a / Rs.50k p.m, then you would need at least Rs.1 crore in bank FD. Not many people would be in such state of luxury to hold Rs.1 Crore in a bank FD.

Solution

What then is a solution to make up for the temporary loss of income/job?

Build a PASSIVE income source via a customized portfolio with a mix of financial assets.

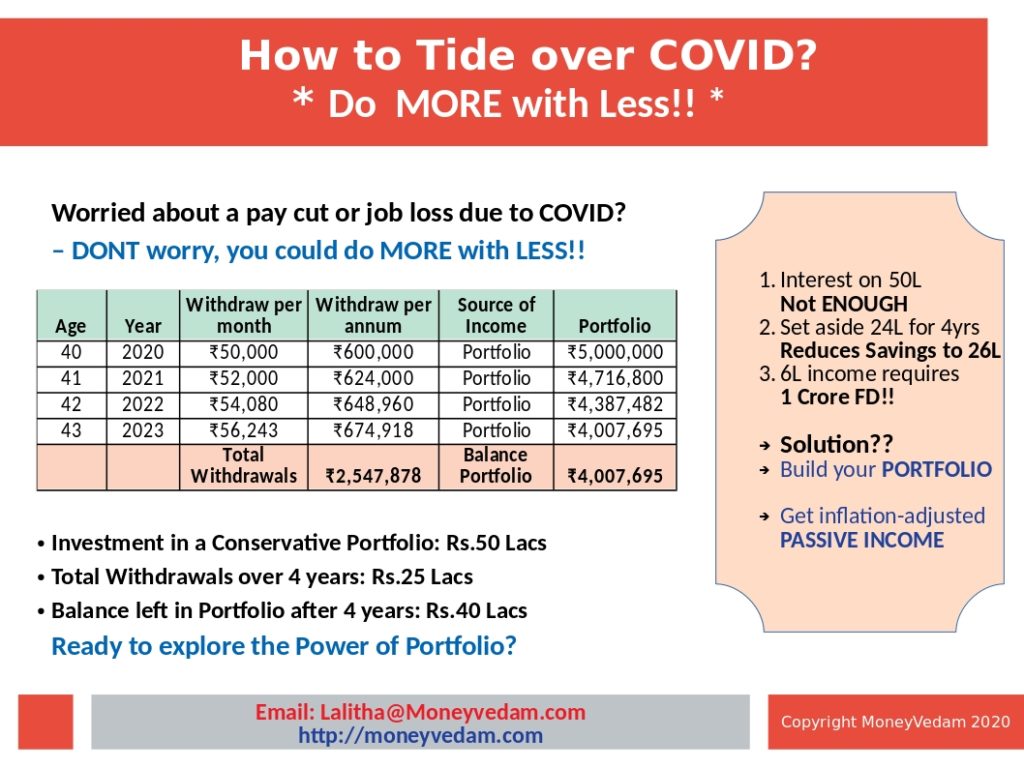

Consider you have Rs.50Lacs that you invest in a customized portfolio (PF). This PF could pay you Rs.50k p.m / Rs.6L p.a. You could also set it up to pay you an inflation-adjusted income year over year. Your cumulative withdrawals add up to Rs.25.47 Lacs – this could have left you with a balance of only Rs.25 Lacs. But notice money in this PF grows every day and as a result it replenishes your PF balance by another Rs.15Lacs. Thus, at the end of 4 years, your PF balance is Rs.40 Lacs.

The above illustration uses a conservative portfolio. In case you wish to bring the portfolio back to the levels of initial investment, even that is achievable with some deft allocation – Are you ready to explore the Power of Portfolios?

Leave a Reply