How to compare financial products?

One of the Top-3 issues faced by investors is how to compare financial products. The previous article discussed the first issue of how to choose a financial product. In this article, lets explore the second issue of comparing products in detail.

Understanding all available choices

Hema, a designer, pays Rs.25k premium p.a for an endownment policy that offers her a life cover of Rs.6L. Now, lets see what other comparable choices she has got – For the same cost of premium, she could either obtain a higher pure term cover for Rs.3 crores (and still claim the 80c deduction) for 25 years or she could invest the sum in another product to grow her money. One question was key for Hema to make a decision – what is her actual objective or intent in buying those 3 insurance policies? She said she would like a life cover. This helped bring clarity and made her chose a Rs.3 Cr pure life term cover.

But lets assume Hema already had a term cover, then where would she invest her Rs.25k annually? She has many products to choose from both fixed income as well as from capital market baskets. There is PPF, NSC, NPS (National Pension Scheme), Tax saving ELSS (Equity Linked Savings Scheme) Mutual funds, Stocks, Company FDs, NCD (Non-Convertible Debt), Gold ETF (Exchange traded funds), Jewels and many more. Note that some of these products may offer her tax rebate while others may not. While tax saving is desired, it should not be the sole reason why you choose a product. Just like Hema, you need to choose a product by not only understanding its merits and demerits, but more so, its suitability to you as an investor.

Metrics for comparison

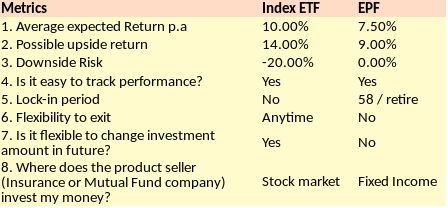

When a product is evaluated on say 5-6 chosen metrics, some metrics such as investment tenure and annualized returns could stand out independently and convince us to make a decision. Say, “I am happy with a 12% return from an ELSS mutual fund” or “I am good with receiving Rs.1.5Lacs after 5 years on Rs.1L investment in NSC”. However some other metrics such as cost and risk(s) may not tell us anything standalone. Such metrics gain relevance only when compared against other financial products.

For example, it is easier to compare the performance of two large cap equity mutual funds. You could compare their returns over 1-yr, 3-yr or 5-yr periods, their expense ratios, their portfolio holdings or even by how much value they lost during a correction or crisis. Most of this information is available on many websites today. But how would you compare this mutual fund against another financial product – say an endowment policy, ULIP, NPS, PPF or an NCD and make an investment decision?

Seek Help

The answer to this question does not lie in those metrics alone. It lies in YOU, the investor’s preference for asset mix, risk-to-reward expectations and most importantly it is dependent on your personal financial goals. The nature of these financial products is so diverse that a simple return comparison does not make any meaningful sense to an investor. And in many cases, it is almost impossible for an investor to understand the hidden risks – for example, how could an investor tell whether a balanced fund is of lower or higher risk than a balanced advantage fund or a ULIP (Unit linked Insurance Plan)?

Ask the right questions or seek help from experts/advisors.

Most investors are good with decision making, where they need help is getting the right set of metrics to bring forth a product’s credentials. By consulting an expert, it is possible to understand the metrics and make an informed investment decision.

In the next article, we are going to look at some of the challenges investors face in timing the entry/exit of the invested products to maximize returns!

Leave a Reply